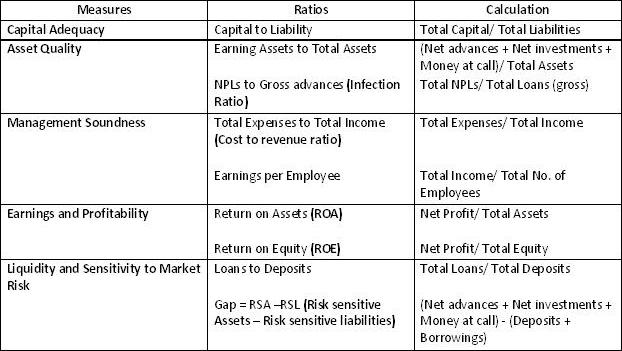

What is CAMELS RATIOS framework?

CAMELS ratios framework involves the analysis of six groups of indicators relating

to the soundness of any financial institution.

These six measures of financial health include:

• Capital adequacy

• Asset quality

• Management soundness

• Earnings and profitability

• Liquidity

• Sensitivity to market risk

Capital Adequacy:

This refers to the ability of the capital base of a financial institution

to absorb unanticipated shocks. Capital adequacy of any financial institution

is instrumental in the formation of risk perceptions about it amongst its stakeholders.

Asset Quality:

This is an important parameter for any banking institution, as the quality

of its assets has a major bearing on the earning ability of that institution.

A deteriorating quality of assets is the prime source of banking problems. Asset

quality is measured in relation to the level and severity of non-performing

assets, recoveries and the level of provisioning.

Management Soundness:

The management of a financial institution is measured against the performance

of its financial indicators. In effect, management soundness is rated in terms

of performance in capital adequacy, asset quality, earnings and profitability,

liquidity and sensitivity to market risk.

Earnings and Profitability:

Profits add to while losses result in erosion of the capital base of a banking

institution. Earnings and profitability are usually measured in terms of returns

obtained on assets or capital employed.

Liquidity:

A liquid position of a financial institution refers to a situation where it

can obtain sufficient funds, either by increasing liabilities or by converting

its assets at a reasonable cost. Thus, it is evaluated in terms of overall asset

and liability management, such that mismatches are minimized.

Sensitivity to Market Risk:

Sensitivity to market risk refers to an institution’s exposure to interest

rate risk, exchange rate risk, equity price risk and country risk.